Southeast Asia isn’t an emerging market anymore — it’s a strategic battleground for B2B growth.

With rapid digitalization across Singapore, Malaysia, Korea, and beyond, the region has become a hotspot for innovation, competition, and buyer sophistication. A 2024 McKinsey study revealed that over 60% of SEA buyers now prefer digital channels over face-to-face engagement - yet most sellers are still using outdated playbooks.

But this shift isn't just about going digital. Decision-making structures have evolved, expectations have changed, and traditional sales models are struggling to keep up. For CXOs and revenue leaders, staying competitive now means adapting to deeper, faster, and more complex buying journeys.

In this blog, we break down four critical market shifts shaping B2B sales trends in Southeast Asia - and explore how strategic sales enablement is helping top teams convert disruption into opportunity.

Shift #1: Decision Making Is Decentralized — Multi-Threading Is No Longer Optional

In Southeast Asia's maturing B2B markets, the decision-making table is getting more crowded - and more complex.

A typical enterprise sale in the region now involves 6 to 10 stakeholders spread across functions like IT, finance, operations, compliance, and even ESG. And while this isn't new globally, what sets SEA apart is how quickly this structure has evolved - especially in mid-market firms that traditionally operated on leaner buying hierarchies.

What used to be a straightforward conversation with a project head or CTO is now a committee-based decision - with competing priorities, KPIs, and influence levels.

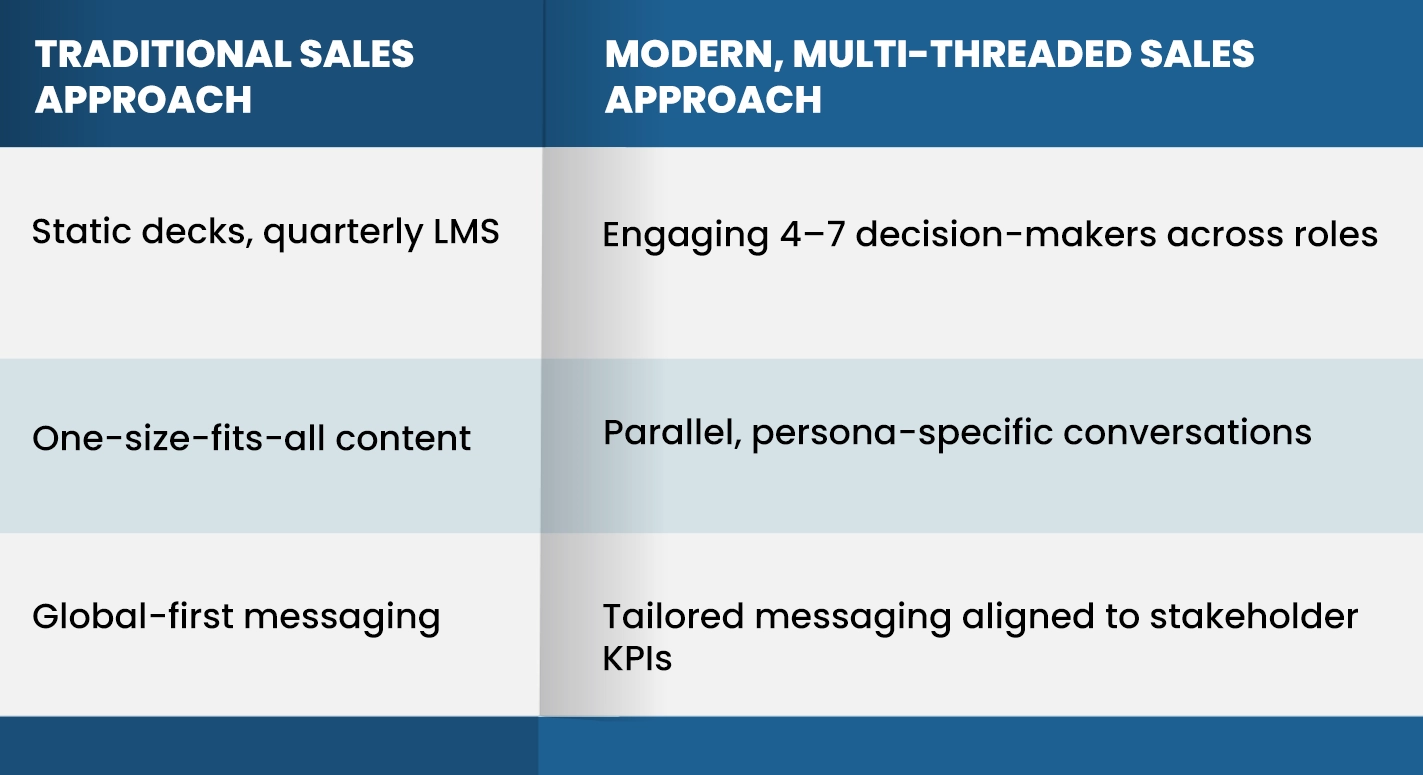

This shift has profound implications for how sales teams operate:

- A procurement officer in Singapore may fixate on contract SLAs and compliance timelines.

- Meanwhile, a CFO in Malaysis is scanning for measurable ROI within two quarters.

- And the head of IT in Korea is asking: "Will this integrate with our existing tech stack without disrupting operations?"

Treating all of them with the same pitch? That's a recipe for stalled deals.

Why This Shift Breaks Old Sales Playbooks

Legacy GTM strategies often rely on a "champion" - someone who internally pushes the deal. But in multi-threaded buying groups, leaning on a single contact creates a brittle funnel. If they exit, deprioritize, or fail to gain internal alignment, the opportunity collapses.

Worse, teams without visibility into other influencers can't preempt resistance or shape a business case that resonates across stakeholder priorities. The result? Deals that stall mid-funnel without clear objection - or worse, go dark after weeks of promising engagement.

This is where sales enablement becomes pivotal - helping teams map stakeholder ecosystems, tailor messaging by role, and equip sellers with the insights needed to navigate complex decision dynamics with precision.

Shift #2: Digital Fatigue Is Growing — Relevance Cuts Through the Noise

One of the biggest paradoxes of today's SEA market is that while B2B buyers are more digitally active than ever, they've also become harder to engage. With decision-makers consuming an average of 13+ content assets before ever speaking to sales (Forrester, 2024), inboxes are full, attention spans are short, and fatigue is real.

But engagement isn't dead. It's just more selective.

A Gartner survey (2023) found that:

- 73% of SEA buyers prefer outreach based on recent product or content interaction

- 61% respond better to industry-specific messaging

- 54% engage more when content reflects local context or case studies

The problem? Most sales teams still rely on static campaigns and generic personas - missing the moment when buyers are most receptive.

This is where intelligent sales enablement steps in. By combining CRM activity, content behavior, and technographic data, teams can trigger persona-level nudges with perfect timing.

Consider this: a supply chain head at a logistics firm in Singapore reads your cloud infrastructure whitepaper. Instead of sending a cold demo invite, you offer a free audit on last-mile tracking efficiency for Singapore-based hubs. That's relevance - not noise.

Organizations that adopt this model have see remarkable results like:

- 2.5X higher email engagement

- 3X more SDR meetings

- 40% faster deal cycles

Shift #3: From Transactional to Consultative — Buyers Expect Expertise, Not Just Products

Gone are the days when product specs and price sheets could move a deal forward. Today's buyers in Southeast Asia - whether in Singapore, Malaysia, or Korea - now expect sales conversations to be consultative, insight-driven, and grounded in real business value. They want reps who understand local market dynamics, anticipate challenges, and connect solutions to outcomes - not just features.

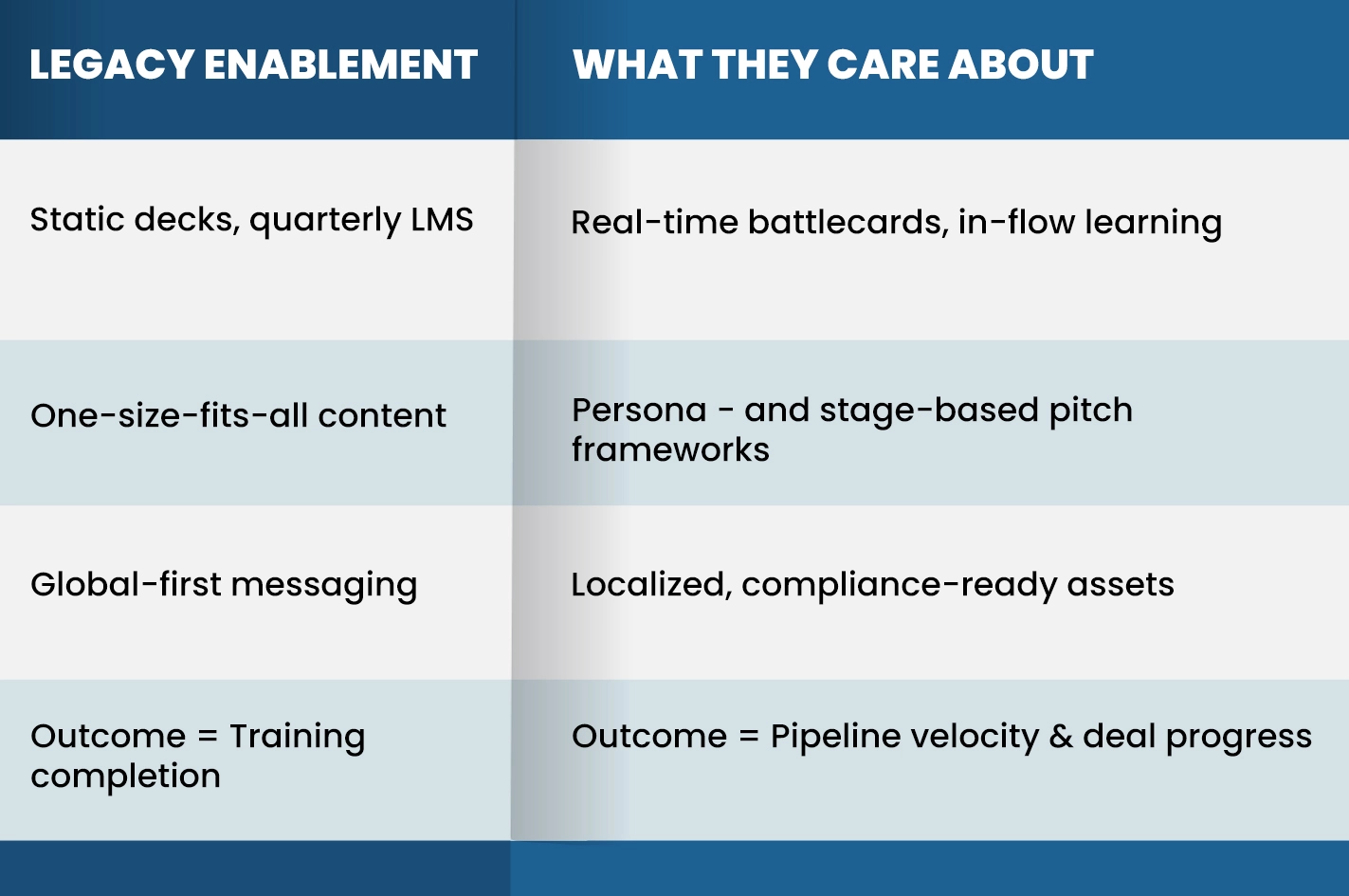

And that's where many sales teams fall short. Too often, reps are product-trained but not market-enabled. This is where strategic sales enablement makes the difference.

What's Working:

Forward-looking companies are building Sales Enablement programs that do more than onboard reps - they create continuously updated knowledge hubs, real-time market playbooks, and persona-driven pitch frameworks.

Pro Tip: Equip reps with localized case studies, vertical-specific pain points, and ROI calculators - not just brand brochures.

Shift #4: Sales Productivity Gaps Are Widening — Enablement Is the New Growth Lever

Despite heavy investments in CRM, outreach platforms, and sales tech stacks, sales productivity in Southeast Asia remains stubbornly low. According to IDC (2024), only 31% of B2B reps in the region consistently meet their quotas - not due to lack of effort, but because they're not set up to succeed.

The issue isn't tools. It's the friction between enablement and execution.

Too often:

- Training is outdated, static, and disconnected from real-time selling

- Sales content isn't personalized or localized

- Reps struggle to access what they need, when they need it

That's why modern enablement is shifting from content delivery to performance orchestration - embedding insights, nudges, and role-specific guidance directly into seller workflows.

In short, the best teams aren't just selling harder - they're selling smarter, with enablement built for outcomes.

Pro Tip: Start by mapping your top-performing reps' workflows. Identify what content, tools, and moments drive conversion - then replicate that enablement at scale. What works in a Singapore telecom pitch may fall flat in a Korean enterprise deal without localized context and timing.

Future-Proofing Sales Enablement in Southeast Asia

In fast-moving B2B markets like Southeast Asia, sales enablement can no longer function as a backend support layer. It must be embedded into your revenue engine - driving consistency, context, and conversion at scale. That means moving beyond decks, training modules, and disconnected tools. It means creating enablement systems that are agile, role-specific, and tightly aligned with market realities.

Here's a 5-point readiness check to assess if your enablement strategy is built for 2025 and beyond:

1. Is your sales content aligned to real buyer journeys - localized by country, vertical, and persona?

2. Are your reps supported with real-time cues and in-flow coaching - not just periodic refreshers?

3. Can your GTM teams act on intent signals across markets like Singapore, Korea, and Malaysia - in time to influence decisions?

4. Is your enablement stack integrated into daily workflows, not siloed in a training portal?

5. Are you tracking enablement impact through metrics that tie back to revenue - like pipeline velocity, meeting conversion, and win rates?

If even one of these answers is unclear, it's time to reframe your enablement model - not as a cost center, but as a strategic growth lever.

Final Thoughts: SEA Sales Success Will Be Defined by Enablement

In 2025, growth won't come from more tools or more outreach - it'll come from sharper execution, richer context, and sales enablement that's built for complexity.

SEA buyers are moving faster, expecting more, and evaluating vendors with a level of scrutiny that demands precision at every touchpoint. The teams that thrive will be those who align enablement with reality - not theory.

That's where Denave comes in. From buyer-mapped content strategies and real-time seller coaching to localized enablement frameworks, our solutions are built to help sales teams win across the nuanced, high-stakes B2B landscape of Southeast Asia. Looking to elevate your sales performance across SEA markets?

Let's talk about how sales enablement - done right - can become your competitive edge.

Read Responses

No Comments

Leave a Reply

Your email address will not be published.